EOS Consumer Study 2023

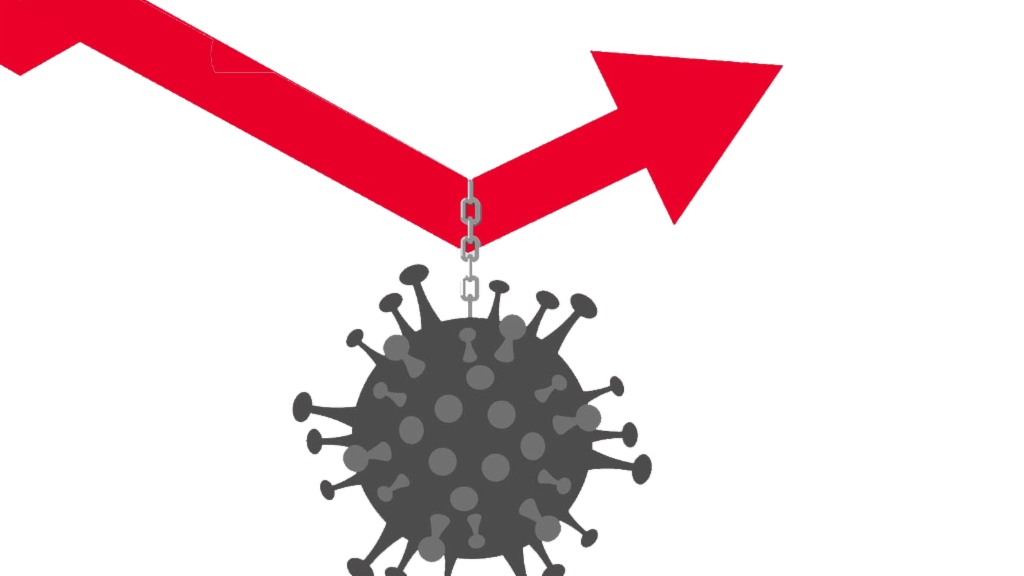

EOS Consumer Study 2023: Is the inflation crisis set to become a debt crisis?

First the Covid-19 pandemic, now record-breaking inflation and an energy crisis: Times have been tough recently, for companies as well as for us as humans. How have consumers in Europe experienced recent months? The “Europeans in Financial Trouble?” EOS Consumer Study 2023 investigated how consumption patterns and payment behaviors are changing in the current economic situation.

For the survey, a total of 7,729 consumers aged between 18 and 65 from 13 European countries provided information about their financial situation. The survey took the form of an online questionnaire and was completed between February 3-9, 2023.

EOS European Payment Practices 2022

EOS Survey “European Payment Practices 2022”: Companies need to step up the pace of their digitalization efforts.

Europe’s companies need to act. Because the payment practices of customers are worse than ever. At the same time, new technologies and social changes are challenging conventional processes and business models.

What are companies doing so as not to miss the boat? How are they making their receivables management more efficient? How data-driven are their decisions – and what is the role of artificial intelligence in this context?

The survey “European Payment Practices”, which EOS conducted in 2022 for the 13th time, provides the answers to these and other questions.

EOS Chatbot Survey 2021

More and more companies in Europe are using chatbots

The technology offers a lot of potential for communication and thus benefits not just companies and customers, but employees as well.

Two out of three companies in Europe are already using chatbots. The results of the recent Chatbot Survey 2021 by the EOS Group provide fascinating insights into how chatbots are currently being used and what expectations will be imposed on them in the future.

EOS survey 2021 "Covid-19 Financial Report"

One in six Spaniards has incurred excessive debt since the outbreak of the pandemic.

Within a very short time, the Covid-19 pandemic has turned our lives upside down. From a financial perspective in particular, the pandemic forced a lot of people to reconsider planned expenditures or to take on debt just to make ends meet. Spanish consumers have also felt the impact. The Covid-19 Financial Report commissioned by the EOS Group shows that in Spain there are people who even slipped into excessive debt over the last year.

All international studies

European Payment Practices 2022

To overview page

The Chatbot Survey 2021

To overview page Download (1.4 MB)

The Covid-19 Financial Report 2021

To overview page Download (240 kb)

“What's the value of data?” 2020

To overview page Download (1.5 MB)

European Payment Practices 2019

Download (1.3 MB)You want to learn more about our studies? Please feel free to contact us.

EOS Spain

Headquarters

Phone: +34 981 079 955

Fax: +34 981 281 931

Business hours:

Monday - Friday: 8:00 a.m. - 9:00 p.m.